triple bottom stocks meaning

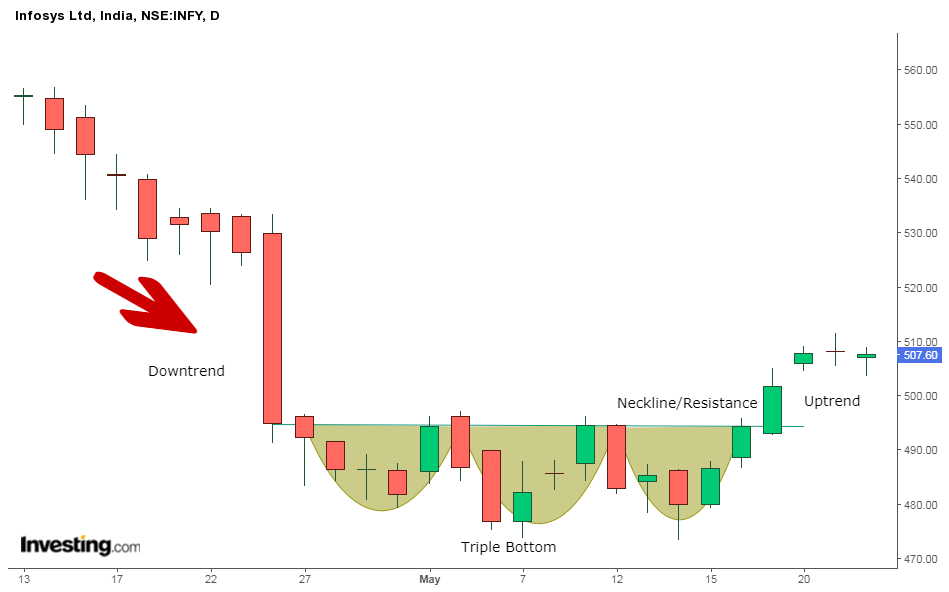

This pattern confirms the continuation of market movement with a higher probability of accuracy. Triple Bottom - Triple Bottom Pattern A triple bottom is a reversal pattern with bullish implications composed of three failed attempts at making new lows in the same area followed by a price move up through resistance.

The Triple Bottom Candlestick Pattern Thinkmarkets En

When it occurs at the end of a downtrend a triple bottom indicates a bullish reversal pattern.

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

. Triple bottom patterns are most often used when the market is falling. It is an economic concept that includes three aspects in its functioning. The triple bottom line TBL is a business and accounting framework that believes companies should care about social and environmental concerns just as they do their profits.

Backtest A normal market will usually come back up to backtest the validity of the break down through the support level. This approach suggests that there should not be one but three bottom lines that a company adheres to. Each of these results focuses on a different activity generating a financial return for investors having a positive impact on people and having a positive impact on the planet.

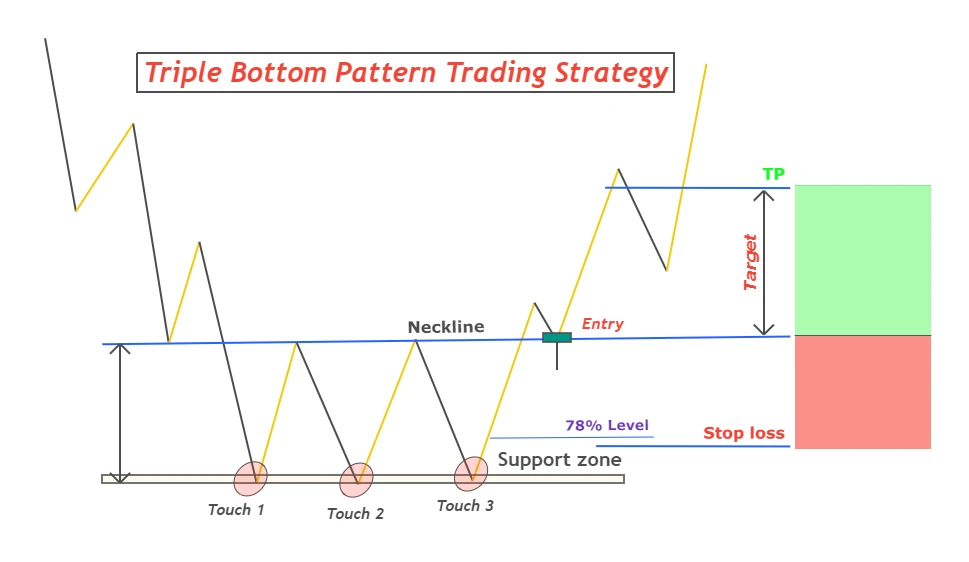

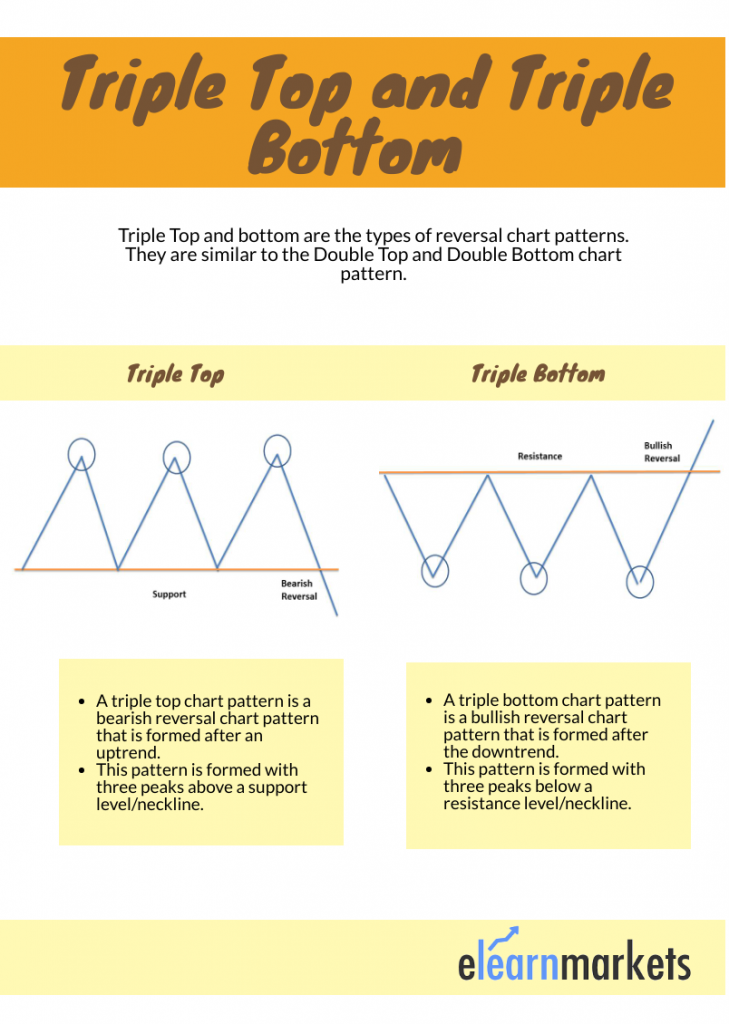

As prices fall back again sellers gain control and volume increases. Triple top and triple bottom patterns are types of forex chart patterns and they are similar to the double top and double bottom patterns. The estimated downside target for the pattern is the height of the pattern subtracted from the breakout point.

Triple Bottom Line is an accounting approach that focuses on creating a sustainable method of execution for corporates. Technical analysts define it as three equal lows followed by a breakthrough over the resistance level. It is a bullish candlestick pattern that consists of three failed attempts at new lows near the same price and is confirmed once the price breaks higher above resistance.

A triple bottom pattern means that the sellers have tried to bring the price down the recent low and have failed the previous three times. Triple Top is a bearish reversal chart pattern that leads to the trend change to the downside. If you see the price of a stock hitting the same resistance level three times in a row you have a triple top.

Lets get started today. This pattern appears when the price forms three peaks or three bottoms at almost the same price level. The triple bottom pattern is important because it is a further indication that the market is moving in one consistent direction.

Conversely if the price drops to a support level three times then you have a triple bottom. Triple Bottom Chart Pattern Triple Bottom is a chart pattern with three bottoms very close in price. It is considered complete indicating a further price slide once the price moves below support level.

Ad Invesco has long been at the forefront of innovation in the ESG space. Triple Top and Triple Bottom patterns are the types of reversal chart patterns. Ad Customizable options contract that cross margin the same underlying stock or index.

Do not obsess over the exact price point. Access ESG-focused ETFs with strategies that align with your values. A triple bottom is a reversal pattern meaning that it is a signal of change in the current direction of a market or trend.

This pattern is rare but a very reliable buy signal. This should be on much lower volume but. The interpretation is that sellers failed to breach the support level three times in a row.

What are triple bottoms and triple tops. However stocks and shares traders use it to forecast the reversal of trends. They are extensions of the Double Top and Double Bottom chart.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. A triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. Whereas Triple Bottom is a bullish chart reversal pattern that leads to the trend change to the upside.

A Triple Top Stock Pattern is formed by three peaks moving into the same area with pullbacks in between. Updated on May 21 2021. Ad Were all about helping you get more from your money.

This is significant to know because. A triple bottom is a chart pattern that occurs at the end of a downtrend. The Triple Top is created when prices break down through the level of the previous consolidation lows and this should be broken on high volume.

Social environmental and financial. The triple bottom pattern forms after prices have been correcting lower. A triple bottom pattern is a bullish chart pattern.

The triple bottom line refers to the financial social and environmental results of a business.

Triple Bottom Pattern And Triple Top The Ultimate Guide

Triple Top And Triple Bottom Chart Patterns Trading Charts Forex Trading Chart

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

The Complete Guide To Triple Top Chart Pattern

How The Triple Bottom Reversal Pattern Works 1 Options Strategies Center

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

Bearish Bullish Reversals Bdo Unibank Inc

Triple Bottom Reversal Chartschool

Triple Bottom What The Chart Pattern Means And How To Make Money Using It Business Standard News

Triple Bottom Reversal Chartschool

Triple Bottom Pattern And Triple Top The Ultimate Guide

The Triple Bottom Candlestick Pattern Thinkmarkets En

Triple Top Pattern Explained Stock Chart Patterns

The Complete Guide To Triple Top Chart Pattern

The Triple Bottom Candlestick Pattern Thinkmarkets En

/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-02-8412f60315fe4e75801c37d04bebd526.jpg)